We recently held the fifth annual Blackbaud Target Analytics donorCentrics Sustainer Summit, hosted by WGBH in Boston on March 23 and 24, 2019, the question on everyone’s mind was simple: following significant gains in donors in FY2017, were we able to retain these surge donors in FY2018? The answer, in short, was yes. This is the Sustainer Summit, after all, a group of sophisticated nonprofits committed to growing and strengthening their sustaining donor programs and nothing has been proven to improve retention better than that.

This year’s summit included 35 large nonprofit organizations that participate in our sustainer program benchmarking to review aggregate program performance, trends and challenges affecting sustainer giving.

Data, drawn directly from participant CRMs and standardized to allow for consistent comparisons, included 17.7 million donors who gave 61.4 million gifts for a total of $2.41 billion in FY2018. (The donor count is the composite sum of each organization and will count donors multiple times who give to multiple organizations.) The analysis is based on a July – June fiscal year, covering the period of FY2014 through FY2018.

In FY2017, the median donor counts from these 35 organizations was 249,385, an increase of approximately 30,000 donors, or 14%, from FY2016. Donor growth in FY2017 was driven largely by a 26% increase in median new donor counts. In FY2017, new donors were 29% of all donors at the median. This figure was in the 24% – 26% range for all other years in the report period.

In FY2018, donor counts declined from the FY2017 peaks. At the medians, overall donors were down by 11%. Donors did remain above FY2016 counts, however, and overall revenue increased by 9% in FY2018. Driving the increase in revenue and shoring up donor counts was the increase in sustainers and sustainer revenue.

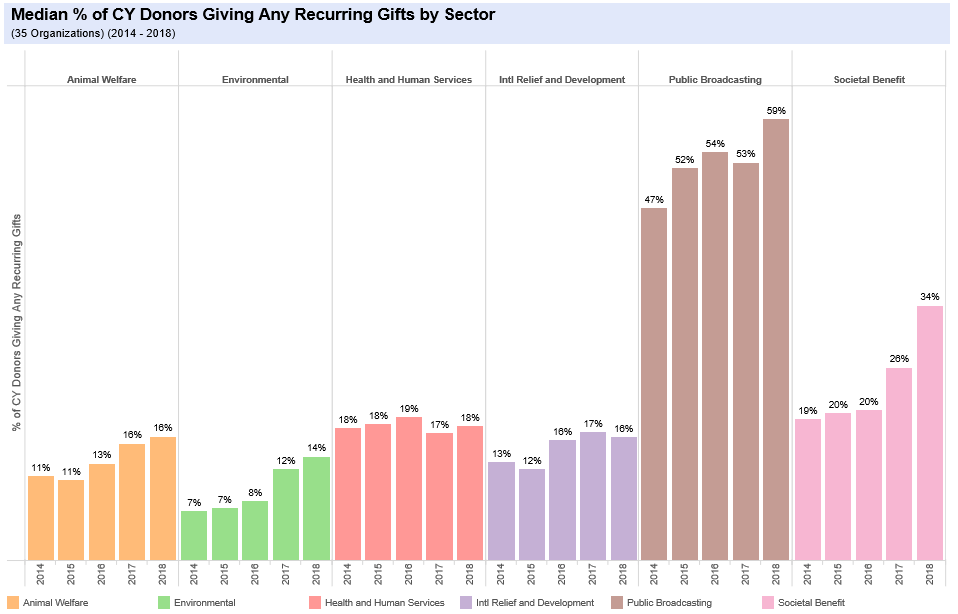

At the medians, the number of sustainers has increased each year since FY2016. By sector, the share of sustainers has increased over time for most. Animal Welfare, Environmental and Societal Benefit-focused organizations have had an increasing share of sustainers each year since FY2016. Trends for International Relief and Public Broadcasting are mixed but trending upward since FY2014. Only Health and Human Services rates are essentially flat, but still healthy at a median 18% of all donors making sustainer gifts across the report period.

The share of Active Donors that are Sustainers increased over time for most sectors.

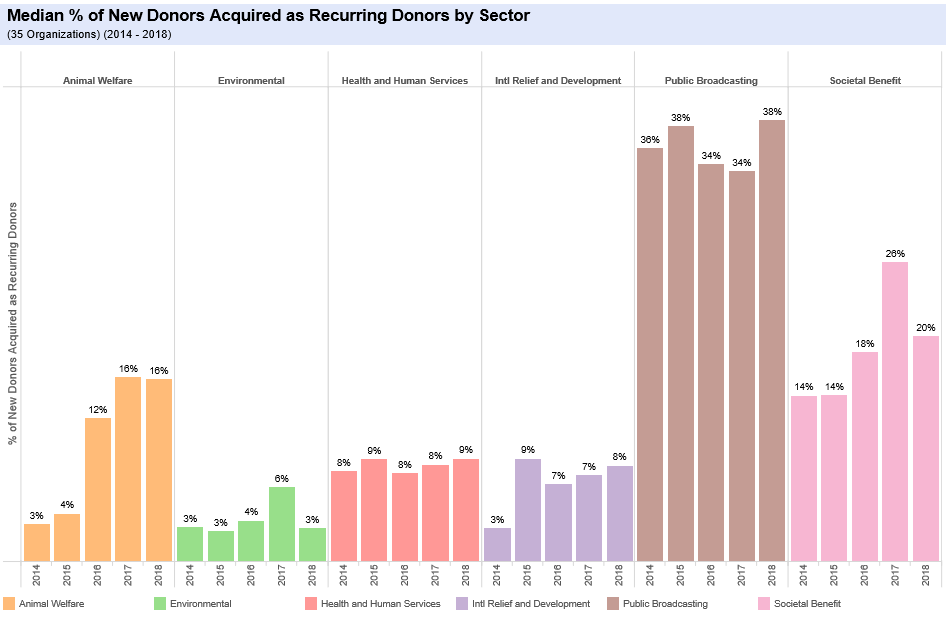

In FY2018, new donor acquisition remained high. The median new donor count was 74K in FY2018, down by just a little over 1,000 new donors in FY2017. The share of new donors acquired directly to sustainers has increased over time for most sectors, though year to year trends are mixed. This will positively impact first year retention.

Though median new donor counts declined from peaks reached in 2017, new donor counts increased over time for all.

Three sources drive nearly all direct acquisition of sustainers: canvassing (face to face and door to door), broadcast (direct TV or radio), and digital channels (email, digital ads and general website). In FY2018, 33% of all newly acquired sustainers were acquired through digital properties. This is very good news for all nonprofits. Not all nonprofits are in the position to conduct canvassing or direct tv campaigns, but all nonprofits can have websites.

Not only is digital already a key component for sustainer acquisition, but it is a growing source for direct acquisition and conversion. In the last five years, there has been an 86% increase in the composite number of new donors who became sustainers with their first gift online.

Key for growing sustainers online is ensuring all digital components are optimized to encourage and accept sustainer gifts. Is sustainer giving the primary ask throughout? Is it the pre-selected option on the donation form? Do ask amounts change based on the donor’s selection of recurring vs single?

Organizations in the summit are looking beyond traditional digital strategies to attract donors to their websites including text messaging conversion campaigns and a strong social media presence. They are also thinking hard about peer-to-peer fundraising campaigns, including Facebook Fundraisers. These gifts will be a growing challenge to manage but are also a significant funding source for a growing number of organizations.

Social media also played a role in the increased news consumption that drove much of the FY2017 donor growth. From responding to natural and manmade disasters to the changing presidential administration priorities, reactionary giving was significant and, as such, retention rates could be predicted to suffer in the following year, FY2018…but that was not the case.

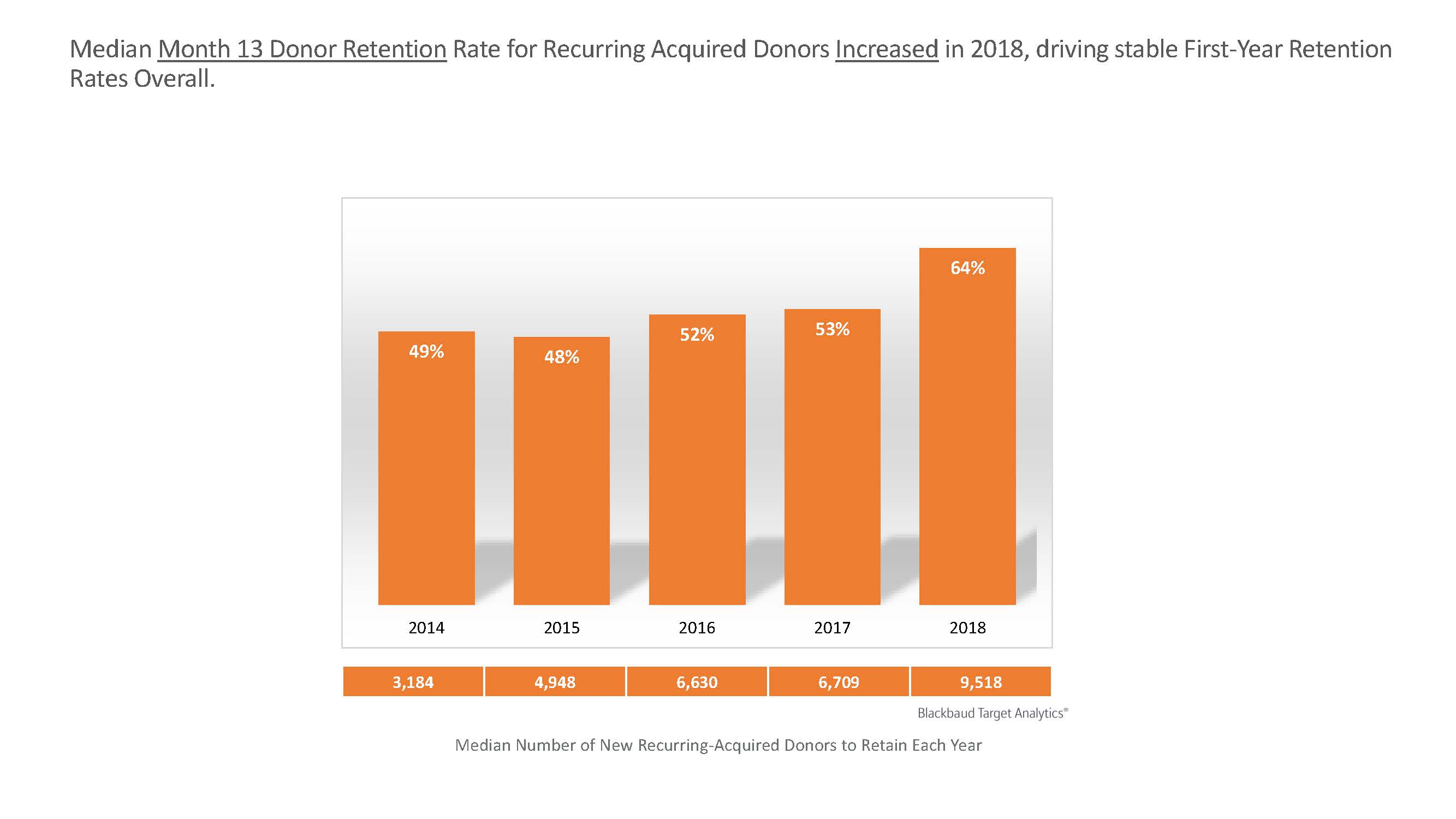

In FY2018, first year retention rates were consistent with FY2017 rates at approximately 35%. Digging deeper, we found that new single gift donor retention rates did decline in FY2018 from FY2017 by 4 percentage points – a not unusual occurrence following a year of increased emergency giving. However, the 13th month retention rate for donors acquired as sustainers in the prior year increased by 11 percentage points in FY2018 to 64%. Having a strong sustainer acquisition process in place at the time of the surge event was critical to keeping those donors on file the following year.

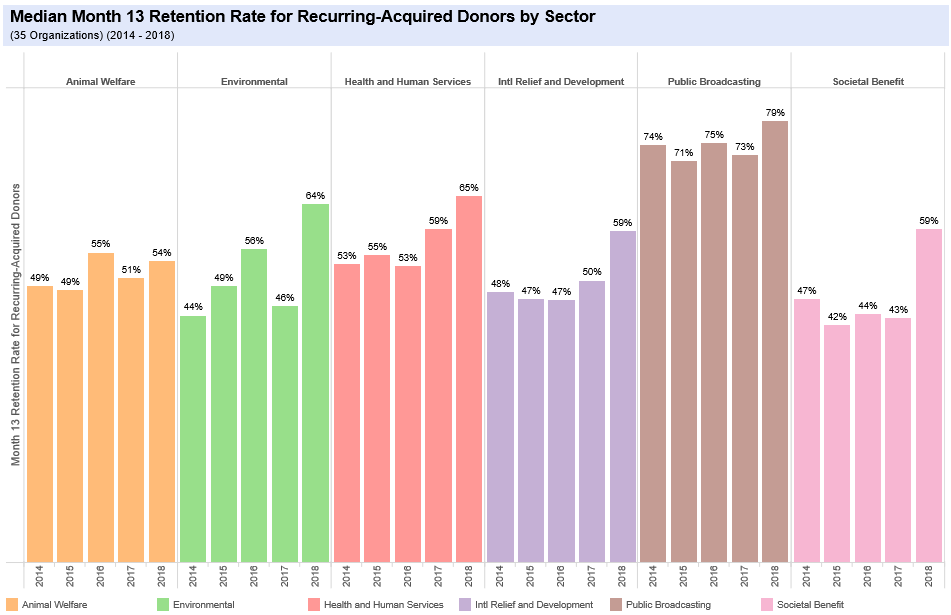

When we review the 13th month retention rate trends by sector, we see an increase in FY2018 from FY2017 for all sectors, with most at their peak rates in FY2018.

What drove the increase in retention rates for these new sustainers? Several key factors, including improving credit card recapture processes, better stewardship, and increasing the use of direct debit as a payment method for sustainers. New sustainers acquired directly to direct debit payment method surpassed 13th month retention rates for new credit card sustainers by 15 percentage points, with a median 78% retention rate for those organizations with large volumes of these donors. (There is also some indication that the on-going news cycle and continued natural and manmade disasters contributed to the higher retention rates in FY2018, but that requires further analysis.)

In FY2019, organizations will be looking beyond retention to increasing the value of these now loyal sustaining donors. Whether that will be by increasing the value of the sustainer gift or acquiring additional single gifts from these donors depends on the organization, though most employ strategies for both.

In FY2018, the median share of on-going sustainers that made at least one additional single gift was 6%, in line with the prior year. The share of multi-year sustainers that increased their average sustainer gift was 12%, down slightly from prior years. In comparison, the share of multi-year single gift donors that upgrade is in the 35% range for most of the organizations in this group.

Key for revenue growth and high donor value over time will be improving our sustainer upgrading strategies. Organizations with high rates of upgrading ask for additional gifts or for permission for automatic, periodic gift increases at the time of sign-up, strategies that have been successfully in place in other markets around the world for some time. While some fundraisers and internal stakeholders may be hesitant to employ these bold strategies as perhaps too bold – “our donors would never go for that” – remember that at one time we said the same thing about sustainer giving.

from npENGAGE http://bit.ly/2VUb1F1

0 comments:

Post a Comment